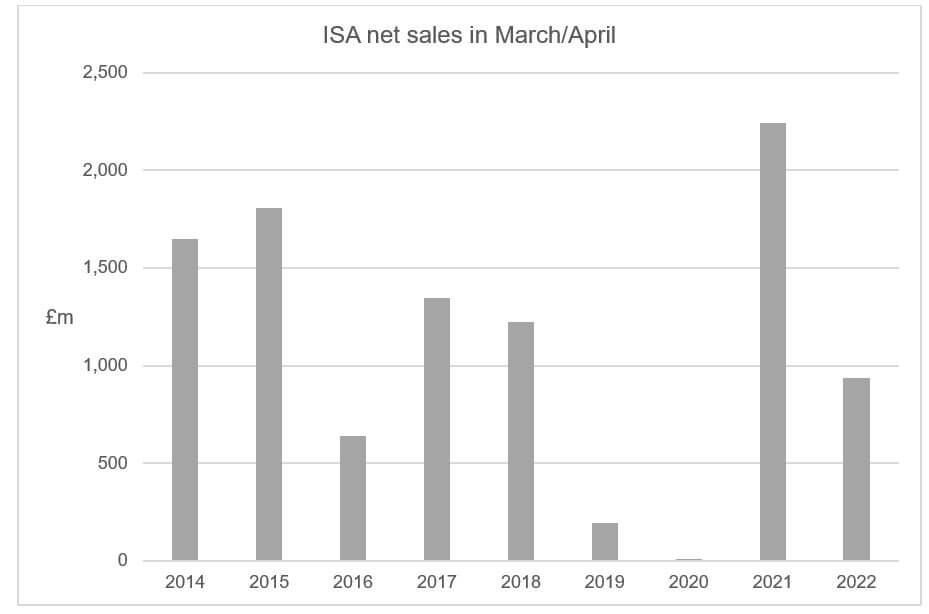

New statistics show this year’s ISA season attracted less than half of last year’s total net investment.

Source: Investment Association

The Investment Association (IA) recently published net sales figures for the ISA season, which it defines as March and April. It showed that the net inflow into the stocks and shares ISAs of its members amounted to £934 million in the two months – a 58% fall on the March–April 2021 figures. The IA gave the figure a positive slant, describing the inflow as ‘just above the average inflows of the last five years (£922 million) despite the challenging start to the year for overall fund flows’. As the graph highlights, the total was also less than in 2014, when the maximum contributions to an ISA were £11,520 (2013/14) and £11,880 (2014/15) against the 2022 level of £20,000.

It is arguably surprising that there was not more interest in ISA investment, at a time when:

- the personal allowance, capital gains tax allowance, dividend allowance and personal savings allowance are all frozen until April 2026;

- all income tax bands (outside Scotland) are similarly frozen; and

- dividends tax rates have risen by 1.25%, to between 8.75% and 39.35%.

It could be that the government has lost interest in ISAs. The main ISA annual contribution limit has not changed since April 2017 (although the Junior ISA ceiling has more than doubled). The introduction of the dividend allowance and the personal savings allowance, from April 2016, means that for many smaller investors the income tax freedom offered by ISAs is not required.

However, with the numbers of higher rate taxpayers rising and the dividend allowance and personal savings allowance both frozen, in theory there is a growing audience to whom the ISA’s UK income tax freedom should appeal.

ISAs have the advantage of removing investment income from your tax calculations. In contrast, despite their names, the dividend and personal savings allowances are effectively 0% tax bands, so the income they cover is still considered for other tax purposes – such as the high income child benefit tax charge or tapering of the personal allowance. While that may not matter to you today, it could be relevant in later years, meaning that the use of ISAs, rather than relying on the allowances, could be a wise precaution.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

The value of the investment and the income from it can fall as well as rise and investors may not get back what they originally invested, even taking into account the tax benefits.

Investors do not pay any personal tax on income or gains, but ISAs may pay unrecoverable tax on income from stocks and shares received by the ISA managers.

Stocks and Shares ISAs invest in corporate bonds, stocks and shares and other assets that fluctuate in value.

Tax treatment varies according to individual circumstances and is subject to change.

The Financial Conduct Authority does not regulate tax advice.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.