How do stock markets fare during conflicts?

Russia’s all-out invasion into Ukraine has been rightly condemned by shocked political leaders worldwide and caused widespread fear amongst investors, leading to stock market falls around the world.

The situation in Ukraine looks like war is inevitable and history tells us that periods of heightened uncertainty are when stock markets suffer the most. So we’ve decided to look back over time to previous periods of conflict and see how stock markets fared during negative geo-political events and afterwards.

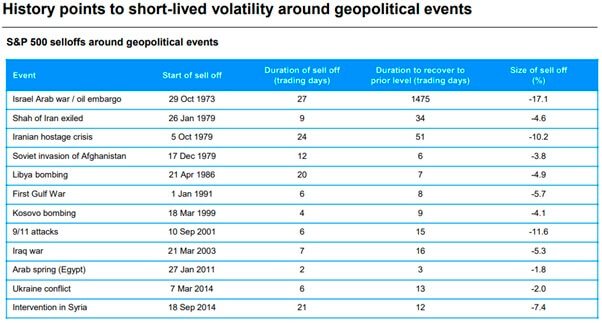

The table above highlights several events of differing degrees of magnitude but we can look to certain events such as the First Gulf War, the 2003 Iraq War and 9/11 attacks and assess their impact on stock markets – in this instance the S&P 500 Index, which consists of the leading 500 stocks in the US.

As we can see, the First Gulf War saw the S&P 500 sell off for 6 trading days straight, falling by 5.7% from peak to trough but only taking a further 8 trading days to recover to its prior level.

For the 2003 Iraq War, the S&P 500 fell over 7 trading days but only by 5.3%, before taking 16 days to recover.

Finally, 9/11. Although an act of terrorism and not a war it was clearly a tragic and seismic event. The impact on the S&P 500 was the harshest, with it falling by over 11% within 6 trading days. However, it only took 15 trading days for the S&P 500 to recover.

What is this telling us?

These facts and figures are largely telling us what we already know – that markets react badly to negative geo-political events. However, as we can see, after an intial sell-off and a period where investors try to digest events, markets tend to recover relatively quickly.

Of course, we have to emphasise that history does not necessarily repeat itself. This situation in Ukraine has escalated quickly and matter could deteriorate still. Stock markets were already in decline leading up to the Russian invasion, and those inflation driven fears have been exacerbated by Russia’s influence on energy provision.

However, on the flip side, the Fed, Bank of England and the ECB may well delay further planned interest rate hikes so as to avoid adding fire to the current market sell-off and risk choking off economic growth.

Avoid knee-jerk decisions

Understandably many investors are very concerned about their investments and are looking to move into cash. Clearly such a decision is dependent on specific circumstances, but our broad message is – don’t do it!

As mentioned, stock markets have generally been weak year-to-date before the invasion of Ukraine. As such, plenty of near-term pain has been taken already. Of course, stock markets can fall even further and if you move into cash and markets fall by another 5%-10% over the next week – well, you’re a hero.

But what if you move into cash and markets rise by 5-10% over the following week? Or you’ve moved into cash, markets have fallen further but now you have to decide when to go back in. Do you go back in when markets have risen by 5%? Or do you wait and by then they’ve recovered by 10%?

Given some of the swift recovery periods shown in the table, we certainly would not want to be making such calls. The old adage comes to mind: ‘it’s about time in the market, not timing the market.’

Long-term focus

For those who have been following investment markets for decades, we’ve been in these types of situations many times. Markets fall, generally sharply as investors panic, but ultimately, they tend to recover – and rise again. That is why we invest for the long-term. Although past performance is no indicator of future returns.

For those investors who have only invested within the last year or so and are possibly looking at some fairly nasty declines in valuations, it is worth remembering that investing in risk assets should be with at least as 5 year time horizon, that stock markets are volatile and that investment portfolios still have the potential to deliver on their investment objectives over the longer term.

An opportunity?

For those investors who have spare cash on the sidelines and can accept the near-term volatility and stock market risk, now could be a good time to put that cash to work.

As one of the world’s most successful investors, Warren Buffet, once said: ‘be fearful when others are greedy, and greedy when others are fearful.’

If you have any further questions, please speak to your financial adviser.

The value of an investment and the income from it could go down as well as up.

The return at the end of the investment period is not guaranteed and you may get back less than you originally invested.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.