In mid-May 2024, the Dow Jones Index crossed the 40,000 threshold for the first time.

You might have noted headlines in May that the Dow Jones Index of US shares had broken through the 40,000 mark for the first time. It may have sounded like a significant landmark, but for professional investors, it was little more than a passing curiosity. Their indifference reflects the fact that, despite its widespread media use, the Dow is not an index they follow. Neither should you, if you want to know how the largest stock market in the world is performing.

The reasons to ignore the Dow include:

- The Dow Jones has only 30 constituents, whereas the professional’s benchmark, the Standard & Poors 500 (S&P 500), has – you guessed it – 500. The Dow’s small selection of shares stems from its origins at the end of the 19th century, long before the era of calculators and computers.

- Modern market indices have strict, systematic rules about how their constituents are selected, usually with regular review when companies are added or ejected. For the Dow, constituents are chosen by a committee and rarely change. How rare is well demonstrated by the fact that Amazon only entered the Dow in February 2024. This was as part of the 58th change since the index first appeared in 1896.

- The standard way to weight the constituents of an index is by their market capitalisation – the bigger the company, the greater its influence. That is what the S&P 500 does, which means (at the time of writing) Microsoft was the top dog with a 7% weighting. Perversely, the Dow is weighted by the share price – a hangover from its simple-to-calculate design. Consequently, its biggest constituent is United Health Group (share price over $500) with an 8.6% weighting, while in the S&P 500, it is ranked 14th with a weighting of 1.1%.

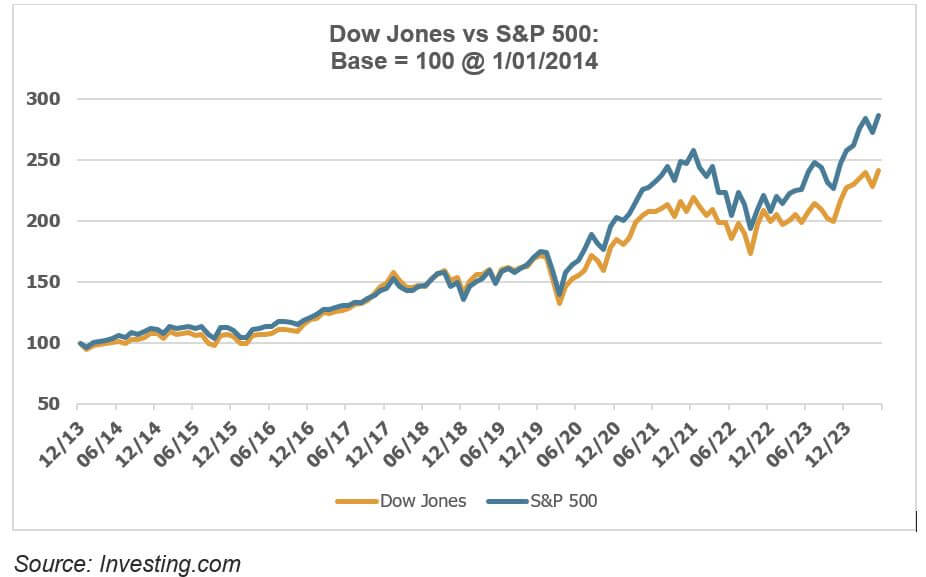

The bottom line is that the Dow gives a distorted picture of how the US market is performing, as illustrated by the graph above. That helps explain why you have a wide choice of funds that track the S&P 500, but virtually none that follow the Dow.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested.

Past performance is not a reliable indicator of future performance.

Investing in shares should be regarded as a long-term investment and should fit in with your overall attitude to risk and financial circumstances.

Content correct at the time of writing.