The Bank of England has suggested that interest rates may rise sooner than expected.

After its August meeting, the Bank of England (BoE) was never expected to announce any change in base rate from the 0.1% set in response to the pandemic. The BoE, like its counterparts in the US, Eurozone and Japan, wants to be convinced of the strength of the economic recovery before moving rates off the floor. However, the August meeting was not as much of a steady-as-she-goes affair as had been predicted.

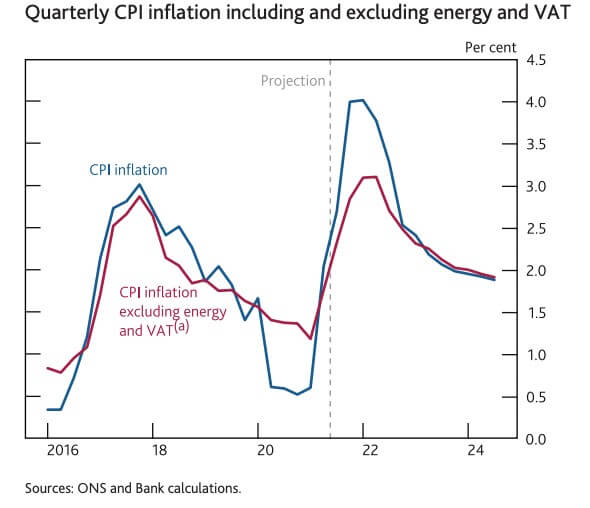

For a start, the BoE revised its estimate for the peak of inflation to 4% around the end of the year. It had previously pencilled in 2.5%, but that rate was reached in June (July’s figure dropped to 2.0%, widely seen as a statistical blip). As the graph shows, the BoE expects a decline from its new peak to be almost as sharp as the inflationary rise beforehand. Cynics may note that such a trajectory is necessary to bring inflation back to its 2% target within the BoE’s forecast period.

The BoE also announced a change to its £895 billion quantitative easing policy, which has resulted in the BoE owning a significant slice of government debt (gilts). Just over three years ago, the BoE said it would start to unwind quantitative easing by not reinvesting the proceeds of its maturing gilts once the base rate had reached 1.5%. At the time, the base rate was 0.5% and heading up to 0.75% in July 2018. With a 1.5% base rate now a distant prospect, the BoE has reduced the trigger level for starting the run down of its gilt stockpile to 0.5%.

Finally, the BoE gave its first real acknowledgement that rates would rise if the economy grew in line with its central forecast: “some modest tightening of monetary policy over the forecast period is likely to be necessary”. Translated from bank-speak, that was taken to mean a 0.5% base rate by 2024.

The conclusion to draw is that inflation will continue to outpace interest rates over the next three years, eroding the value of cash deposits. If you are holding more in banks and building societies than you need as a reserve, an alternative home for the excess could make a lot of financial sense.

The value of your investment and income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Content correct at the time of writing and is intended for general information only and should not be construed as advice.